Another reason why I decided to relook into the tax computation in my article was because I am contemplating myself if the 3% reduction is worth the effort.

Let me be clear first. I had written twice on this blog why I disagree with the move to reduce EPF deduction to stimulate the economy. You can read them here and here. Both times, I did not back up my writings with analysis.

So let's have a look, again. This time, we will be talking to our two friends, Ali, from the previous article, and Abu.

Ali the Ignorant Bugger

Say hi to Ali again. Despite the previous lesson, he is still very much ignorant of his rights as a taxpayer. He did not buy PRS (Private Retirement Scheme - launched by Govt to augment EPF savings). And he doesn't have education and medical insurance.

|

| Ali's Income Tax at 11% |

|

| Ali's Income Tax - Effect of 8% EPF Deduction |

|

| Ali's Income Tax - Net Effect of EPF Reduction on Tax to be Paid |

Abu the Smart Kid

Let's talk to Abu. Abu is a smart kid. He knows about PRS and he knows about medical and educational insurance. So he maximised both by investing RM3,000 into PRS and another RM3,000 into medical insurance.

|

| Abu's Income before the EPF Reduction |

|

| Abu's Income Tax after the EPF Reduction |

|

| Net Effect of the EPF Reduction on Abu. |

Analysis

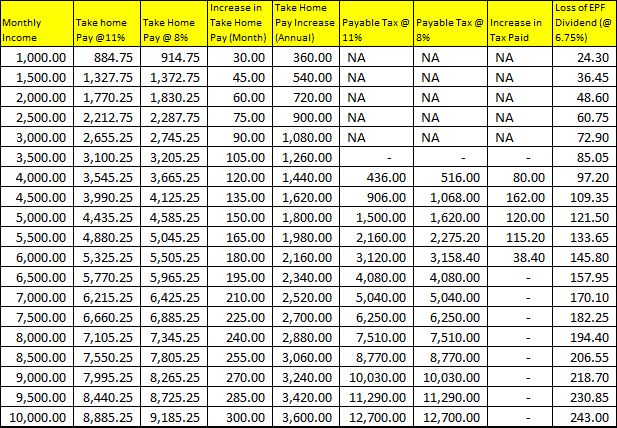

As you can see, there is a marginal increase of income tax but only for those with income between RM4,000 to RM6,000.

The slight upward shift of their income had resulted in them need to pay an additional income tax between RM38.40 to RM 120. However, this is very minimal as compared to the increase of their take-home pay. Those with income of RM5,000 for example, has an increase of RM1,800 take-home pay versus increase of RM120 in tax.

You will notice there is a column for Loss of 6.75% EPF dividend. This is based on EPF dividend declared for the year 2014. Do note, that with our current economic climate, do expect this figure to be actually lower. But that is remain to be seen.

Disclaimer

To make your life and mine easier, these are some of the disclaimers.

- This article is not endorsed by LHDN. Therefore, please get your tax advise from either your personally appointed tax agent, or from LHDN. LHDN people are very helpful, so do not worry. They make sure the act of extracting tax from you is as painless as possible.

- For salaries below RM3,000, they were not deducted with RM14.75. Instead, they are deducted against whatever amount due to SOCSO in accordance to SOCSO table.

- Not all personal relief are included here. To know what tax relief is available for you, you may find them here.

- I had used the Monthly Tax Deduction Schedule for 2016. The effect of EPF deduction will only be seen in Year of Assessment 2016, which would be declared in April 2017. You may find the table here.

- For EPF deduction, I had arbitrarily used 11% instead of using EPF schedule. For the actual table, you may refer here.

- For income tax schedule for Year of Assessment 2016, you may find it here.

- The biggest mistake made in the previous calculation was the selection of correct income for deduction. In my previous article, I had wrongly selected to use net income instead of the aggregated income, which is supposed to be gross income. A better explanation can be found here.

Conclusion

There is basically not much tax effect if one has planned their tax properly.

Wait!!!

With proper tax planning, there is a way that you will get net zero effect of increase in income tax. And you get to get a big tax refund cheque in April 2017.

How?

Instead of spending your hard earned cash buying the latest gadget, you can save your money by getting a life insurance.

Meet Ahmad. He's smarter than Abu and Ali. He bought life insurance for himself. Not only the insurance would pay to his family if something bad happens to him, it also has disability benefits, in case one day Ahmad woke up finding himself without a hand or leg.

|

| Ahmad - With Life Insurance |

|

| Ahmad's Income with Insurance Top Up |

|

| Ahmad's Income |

Conclusion, again

I hope I had clarify the questions that many of us have. It does look unbelievable that many of us are actually receiving tax refund. But that is just the truth. Most salaried individuals do receive tax refund. So who is the taxpayer again?

Hi,

ReplyDelete1. I believe you are right on this.

2. I'll need to check if there's wrong in the formula.

3. Thank you for the exact amount.

Most appreciative of your comments.

I'm afraid the increase is not marginal for those with statutory income between RM47,826 and RM49,437. Assuming the statutory income is made up of monthly basic salary only (no fixed allowances, no bonuses), they are employees drawing monthly basic salary of between RM3,986 and RM4,119. You could not see that because you've wrongly assumed that everyone is entitled to the tax rebate of RM400. As rightly pointed out above, the tax rebate is only available if the chargeable income is below RM35,000.

ReplyDeleteThe chargeable income of this group of employees would not exceed RM35,000 if they contribute 11% to EPF, assuming they are not as smart as Abu. What happen if they contribute 8% instead? Chargeable income would exceed RM35,000, leading to a double whammy - they are no longer entitled to the tax rebate, and they will move up to the next tax bracket (RM35,001 - RM50,000; tax of RM900 for the first RM35,000 and chargeable income in excess of RM35,000 is taxed at 10%).

In fact, those with statutory income of between RM48,086 and RM49,437 (monthly basic salary of RM4,008 to RM4,119) would be badly hit. Fyi, the reduction in EPF contribution will be effective only until December 2017. The double whammy as explained above would apply to the employees within this sub-group in both YA2016 and YA2017. They would ended up paying approximately RM1,000 more in tax in both years combined.

Agree that the increase is marginal for those drawing monthly basic salary of RM4,200 to RM6,250 as they would not be experiencing any double whammy. However, those drawing a monthly basic salary of RM5,344 to RM5,416 (statutory income of between RM64,131 and RM65,000) may see a greater spike as they will also move up to a higher tax bracket if they decide to contribute 8% to EPF.

First, I love how you all are approaching this with me. I will look into the ratio next month, once my backlog at office clears up and I have completed my assignments.

DeleteOn the tax rebate, yes I agree I made a mistake there. Will look into how this affects.