In a surprising turn of event (13 February 2018), Reuters UK had reported that BAe (British Aerospace) is still eyeing to clinch the prized MRCA supply contract to RMAF, believed to be worth between RM7 to RM8 billion. The attempt, believed as a last ditch attempt to get the coveted contract as BAe had poured huge amount of effort to secure the contract.

The MRCA, short for Multi-Role Combat Aircraft is probably one of the most protracted tender process in the world, stretching from 2002 until today, across the administration of 2 defence ministers and at least 3 Air Force Chiefs.

In this latest update, BAe has proposed to Putrajaya to be given a soft financing backed by the UK Government to procure the jets. the offer now includes a soft financing to Putrajaya to procure the jets.

Affordability

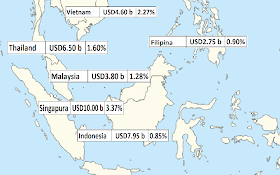

Both D'assault Aviation and BAe have priced their offers circa USD2 billion, which is about 0.6% of Malaysian GDP as at 2016 (GDP 2016: USD296.36 billion). Note that Malaysian Government has historically been notorious in spending token amount for defence, being ranked 4th in ASEAN at 1.28% of 2016 GDP. This is far cry below the recommended 2% made by NATO to their member nations.

Both D'assault Aviation and BAe have priced their offers circa USD2 billion, which is about 0.6% of Malaysian GDP as at 2016 (GDP 2016: USD296.36 billion). Note that Malaysian Government has historically been notorious in spending token amount for defence, being ranked 4th in ASEAN at 1.28% of 2016 GDP. This is far cry below the recommended 2% made by NATO to their member nations.

|

| Fourth highest amongst those surveyed. |

This prudish defence expenditure as compared to her neighbours have left His Majesty's Malaysian Armed Forces facing possible block obsolescence. Block obsolescence occur when a class of assets become obsolete due to either technological changes in the battlefield or critical changes in tactics and strategies that led to revolution in military affairs.

At the current going price, it has little negative effect on the national GDP. Even the debt-to-GDP would not be severely affected, especially with the now improving economic outlook. Therefore, affordability is and should not be an issue.

Political Interference

However, the large nature of the purchase would very likely irk social activists and leftists who tend to see defence procurement as waste of funds. Already, the left-wing Parti Sosialis Malaysia (PSM) had released an election manifesto titled the 99% had already pledged to lower the defence expenditure to a ridiculously low less than 1%. And at least 1 pro-opposition netizen had lamented how much scholarship could have been given in the RM7 billion is spent on scholarship.

|

| Screenshot of a known PBPM supporter supplied by undisclosed source. |

A utopia I must say, to have a defence budget of less than 1% of the GDP.

Major SLOC and Overlapping Claims

Unfortunately for Malaysia, the fact that we are sitting on a major Sea Line Of Communication (SLOC) and having several overlapping border claims with our neighbours, prevent us from being too prudent with our defence expenditure.

Haphazard Past Procurement

This is worsened by the haphazard defence procurement made after end of the PERISTA programme. Despite the small size of RMAF, the air force was forced to procure jets from up to 6 different countries (the US, UK, Italy, Russia, Canada and France), all for the so-called sake of diplomacy, causing severe complications to RMAF logistics support.

So would BAe's new offer be able to sway Putrajaya's decision on this? Personally, I doubt it. Let's look at the following which I believe would compel Putrajaya's selection of Rafale as the next MRCA for RMAF.

So what has made D'assault as Malaysian Government firm favourite compared to BAe's Typhoon?

So far, I have little details on what the French are willing to offer to Malaysia. What titbits I had obtained, unfortunately either could not be independently substantiated or discussed in open forum. Hence, I would not be sharing them.

The only details that I can find officially on the French offer are that they too provide soft financing to procure their Rafale and that they have made a commitment to disregard European Union's decision to boycott our palm oil. France being a key member of the union has more say in the European Union and would be able to play a far larger role in influencing the European Union to change their view on the oil, as compared to Britain which had voted to exit in the Brexit move.

However, despite the lack of details on the French offer, what I can surmise is that there is an element of interoperability between many of Malaysian Armed Forces assets with the Rafale, which had piqued the interest from MAF top command. Other MAF assets that are supplied or has key French components are the SU30MKM (avionic suite) jets, Polish-made PT91M Twardy (fire control system and communication system) medium Main Battle Tanks, A400 strategic lifter, Perdana class submarines, Maharaja class Littoral Combat Ship (LCS). In fact, this was one of the key factors that I had identified as primary reason why Rafale would be the most likely winner of the project in a discussion with a (now former) air force personnel.

Another key element which points to a possible Rafale deal is the complete take-over of Sepang Aircraft Engineering Sdn Bhd as an Airbus subsidiary. The subsidiary will be involved in the MRO (Maintenance, Repair and Overhaul) business. Airbus being a substantial shareholder in D'Assault Aviation, is likely to be contracted by D'Assault Aviation to provide MRO services Rafale jets when required. This in turn would be inline with the National Aerospace Industry blue-print.

How About BAe's Offer?

I'm not sure if the newly updated BAe offer still include the upgrading of the BAe Hawk 208 and 108, as the report did not mention on both. Nor if any of the past offers still stand.

I'm not sure if the newly updated BAe offer still include the upgrading of the BAe Hawk 208 and 108, as the report did not mention on both. Nor if any of the past offers still stand.

However, I am quite concerned with BAe's offer to provide the soft-loan to Putrajaya. While the soft loan is tempting, further information are required. I am very interested to know if the soft loan, to be syndicated by UK Credit Agency, would be denominated in which currency.

If the loan is to be denominated in foreign currency, it would be very detrimental to Malaysian economy as a whole. We learnt the lesson the hard way in the 1990's when the instalment payment for soft loan given by the Japanese government had balloned almost 3 times their original loan value in ringgit due to the depreciation of ringgit. Indonesia, our neighbour is also facing the same conundrum. After borrowing heavily in foreign currency, they had to increase the repayment amount due to severe depreciation of Indonesian Rupiah. This in turn will impact Indonesian government repayment capacity for at least a few years.

Going by past experience, if financing is granted, most likely the government would try to get the British to issue the security in RM and in Malaysia. The ECRL project to build a double-tracked railway line to the East Coast is being financed with a RM55 billion soft loan from China for the very same reason, the loan being disbursed in Ringgit Malaysia.

The policy to have the loans disbursed in Ringgit Malaysia has roots in Bank Negara Malaysia's Foreign Exchange Administration (FEA) Rules. The rules, written as baseline rules by Bank Negara Malaysia to protect the independence of Malaysian monetary regime, is another frontline that many Malaysians are unaware of. The price of failure to defend the independence of Malaysian monetary regime would be similar to that of Greece; without control over monetary policy, the mounting debt led to the financial collapse of Greece government.

But would the British government be willing to go to that path? Or a better question, would the British government be able to legally issue the loan in Malaysia in RM? Unlike China's loan of RM55 billion which was syndicated by Bank of China, Malaysia, which is also the designated clearinghouse for Renminbi in ASEAN, Britain does not have the same outreach despite Malaysia being Britain's former colony.

Do note, I have the same concern with the French soft loan offer.

Financially, the UK Credit Agency may not be keen to finance the soft loan for two reasons.

Negative News Involving Malaysia

Thanks to the unrelentless news on 1MDB, large financial loans to the Malaysian Government may invite unwanted scrutiny from self-appointed watchdogs in the UK, which may force the UK government to release details on the financing. While backdoor handling of such issues can be planned, this may in turn not politically favourable to the current British government.

Thanks to the unrelentless news on 1MDB, large financial loans to the Malaysian Government may invite unwanted scrutiny from self-appointed watchdogs in the UK, which may force the UK government to release details on the financing. While backdoor handling of such issues can be planned, this may in turn not politically favourable to the current British government.

Potentially Large Foreign Exchange Loss

Assuming the UK Credit Agency is able to recruit either Standard Chartered or HSBC to syndicate for the loan in Malaysia, who would be willing to shoulder the potential foreign exchange loss due to translation of the funds from Pound Sterling to Ringgit Malaysia, and then back to Pound Sterling?

Assuming the UK Credit Agency is able to recruit either Standard Chartered or HSBC to syndicate for the loan in Malaysia, who would be willing to shoulder the potential foreign exchange loss due to translation of the funds from Pound Sterling to Ringgit Malaysia, and then back to Pound Sterling?

Would the French have similar concerns with the above? Maybe, but based on their willingness to provide the same financing to Egypt despite having the military usurping the democratically elected president Mohamed Morsi al-ayat and his Freedom and Justice Party via a coup.

Uphill Task for BAe

BAe realise and understand they are in an uphill battle. Their focus in building the brand around the Typhoon had led to miss out on other areas of needs of MAF, which had led it to be exploited by the French via their multiple defence contractors.

BAe realise and understand they are in an uphill battle. Their focus in building the brand around the Typhoon had led to miss out on other areas of needs of MAF, which had led it to be exploited by the French via their multiple defence contractors.

The French has done a very good homework in securing ground for the contract. After all, they had been trying to market their Rafale to Malaysia since 1990's when they first brought the earlier iteration of Rafale to Malaysia for demonstration which was attended by then Prime Minister, Tun Mahathir.

Quoting from source within Malaysia Military Power (MMP), "French already outflank the Brits by saying they officially oppose the palm oil ban and will support Malaysia palm oil. In the other hand if malaysia did not choose Rafale.. The French will f(tuut) up Malaysia palm oil industry left and right.. Hook and sinker. The Brits cant influence the Palm oil issue because of the brexit. By the way, French also offer Financial Package and it's a 10 year repayment loan from a French Commercial bank and guaranteed by the French Government ".

Personal View

On a personal note, the news of the impending French contract brought a mixture of feeling for myself. Rafale is my personal choice. But I'm concerned of the operational cost.

In terms of capabilities, the Rafale is far more advanced than even our SU30MKM. In fact, I believe the Rafale should be replacing the SU30MKM in the long run.

This still leaves a gap in our airspace defence as I believe it should be replaced with something by a lower tiered aircraft, like the Super Hornets, or even the South Korean FA50.

However, I can only share my view and try to convince those in power. As long as at the end of the day, those in power can ensure that His Majesty's RMAF are able to continue to fly and defend our beloved nation.

I must take note also that further delay in replacing the MiG29 would force RMAF to continue deploying BAe Hawk 108 trainer and BAe Hawk 208 combat aircrafts despite having suffered one fatal crash killing 2 very experienced combat pilots. Once the MRCA has been decided, only then a replacement for the Hawk 108 trainer can be selected.

Other articles covering similar topics.

I believe all the experts and specialist in RMAF have their complete through analysis for both MRCA candidates( I presumed with not distracted by visit Malaysia logo issue). At with all the best verdicts made, only political decision is the most crucial reason for the last call to buy off. At the time being to me it's just another rotation of news for MRCA Replacement programme. Interesting to hear but nothing would ever changing in the end for at least post 202x-an era.

ReplyDelete